“Geralmente a solução do governo para um problema é tão ruim quanto o próprio problema.”

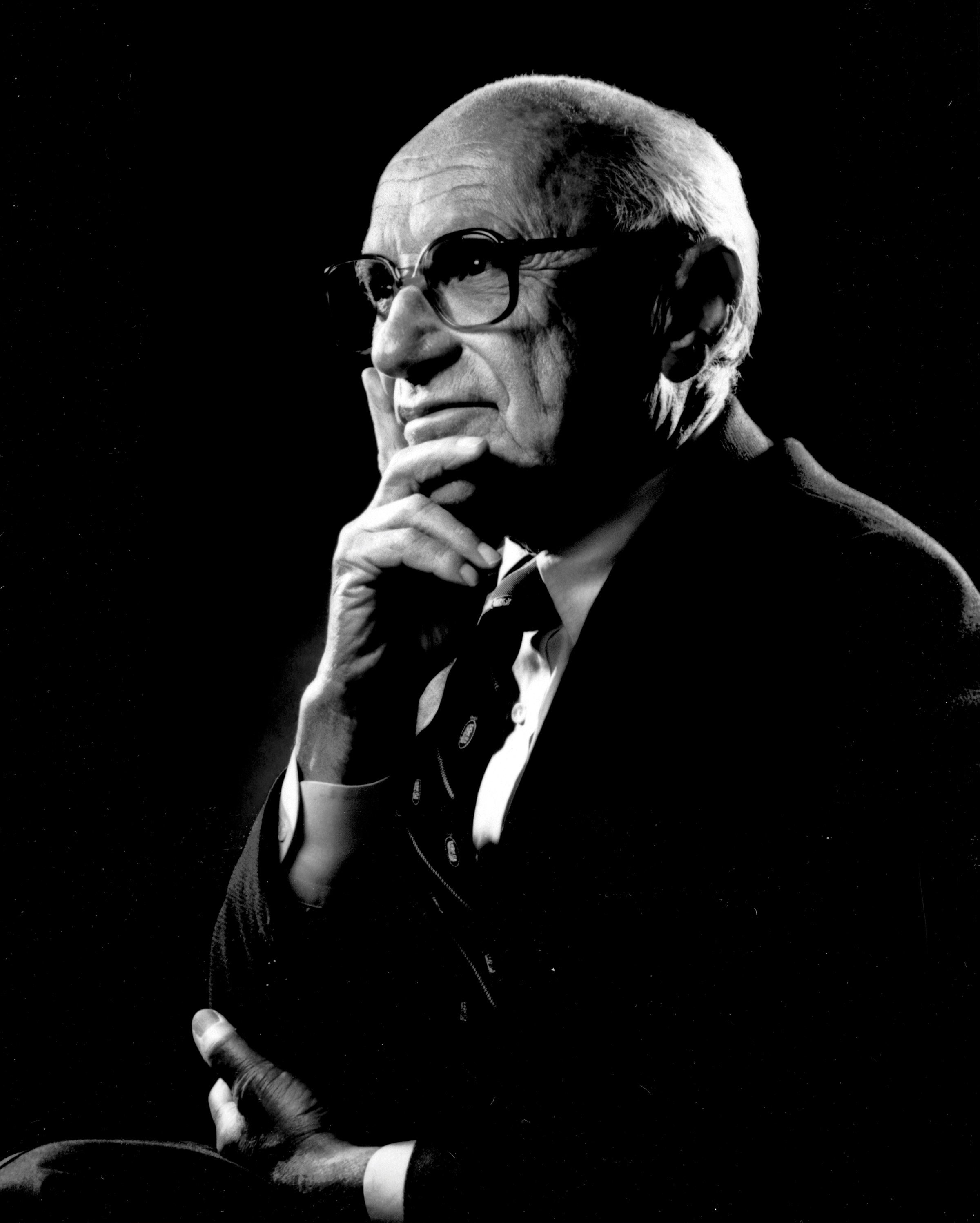

Milton Friedman

Com fontes

Milton Friedman foi um economista, estatístico e escritor norte-americano, que lecionou na Universidade de Chicago por mais de três décadas. Ele recebeu o Prémio de Ciências Económicas em Memória de Alfred Nobel de 1976 e é conhecido por sua pesquisa sobre a análise do consumo, a teoria e história monetária, bem como por sua demonstração da complexidade da política de estabilização. Wikipedia

“Geralmente a solução do governo para um problema é tão ruim quanto o próprio problema.”

Milton Friedman

Com fontes

“A sociedade que coloca a igualdade à frente da liberdade irá terminar sem igualdade e liberdade.”

Milton Friedman

From Created Equal, the last of the Free to Choose television series (1990, Volume 5 transcript) http://www.freetochoose.com/1990_vol5_transcript.html.

Com fontes

http://www.foxnews.com/story/0,2933,230045,00.htmlASMAN,David . Free to choose: Transcrição da entrevista com o economista Milton Friedman realizada em 15/5/2004. Your World, Fox News, 16/11/2006

Com fontes

Milton Friedman

Introd. de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 2 "O papel do governo numa sociedade livre" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 12 "Problema da pobreza" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 1 "A relação entre liberdade econômica e liberdade política" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 8 "Monopólio e a responsabilidade social do capital e do trabalho" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 11 "Medidas para o bem-estar social" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 11 "Medidas para o bem-estar social" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 1 "A relação entre liberdade econômica e liberdade política" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 1 "A relação entre liberdade econômica e liberdade política" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 1 "A relação entre liberdade econômica e liberdade política" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 3 "Controle do dinheiro" de "Capitalismo e Liberdade".

Com fontes

“O governo nunca aprende, as pessoas é que aprendem.”

Atribuídas

Variante: Os governos nunca aprendem. Só os governantes -- quando saem.

Milton Friedman

Cap. 13 "Conclusão" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 10 "Distribuição de renda" de "Capitalismo e Liberdade".

Com fontes

Erroneamente atribuídas

Milton Friedman

Introd. de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 8 "Monopólio e a responsabilidade social do capital e do trabalho" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 10 "Distribuição de renda" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 11 "Medidas para o bem-estar social" de "Capitalismo e Liberdade".

Com fontes

Milton Friedman

Cap. 12 "Problema da pobreza" de "Capitalismo e Liberdade".

Com fontes

“Por que não correr riscos? Eles sabiam que seriam resgatados se algo desse errado.”

Milton Friedman

Milton Friedman, economista e prêmio Nobel, sobre a crise nos países asiáticos; citado em Revista Veja http://veja.abril.com.br/231298/p_012.html de 23/12/98.

Com fontes

“Nós temos um sistema (político) que aumenta impostos sobre o trabalho e subsidia o não-trabalho.”

We have a system that increasingly taxes work and subsidizes nonwork.

citado em "U.S. news & world report: Volume 82", U.S. News Pub. Corp., 1977

Atribuídas

“Governments never learn. Only people learn.”

citado em "The Defense Travel System: Boon Or Boondoggle" - Página 1 http://books.google.com.br/books?id=75FZLmalK5kC&pg=PA1, DIANE Publishing, 2005, ISBN 1422332500, 9781422332504

Atribuídas

“Governments never learn. Only people learn.”

Statement made in 1980, as quoted in The Cynic's Lexicon : A Dictionary Of Amoral Advice (1984), by Jonathon Green, p. 77

One role of prohibition is in making the drug market more lucrative.

America's Drug Forum interview (1991)

Fonte: (1962), Ch. 1 The Relation Between Economic Freedom and Political Freedom, 2002 edition, page 15

“Society doesn't have values. People have values.”

From Created Equal, an episode of the PBS Free to Choose television series (1980, vol. 5 transcript) http://www.freetochoosemedia.org/broadcasts/freetochoose/detail_ftc1980_transcript.php?page=5.

Fonte: (1962), Ch. 3 The Control of Money, p. 50

Fonte: Free to Choose (1980), Ch. 1 "The Power of the Market", page 13

Contexto: The key insight of Adam Smith's Wealth of Nations is misleadingly simple: if an exchange between two parties is voluntary, it will not take place unless both believe they will benefit from it. Most economic fallacies derive from the neglect of this simple insight, from the tendency to assume that there is a fixed pie, that one party can gain only at the expense of another.

As quoted in If Ignorance Is Bliss, Why Aren't There More Happy People? (2009) by John Mitchinson, p. 87

"Milton Friedman" in William Breit and Roger W. Spencer (ed.) Lives of the laureates

Lecture "The Suicidal Impulse of the Business Community" (1983); cited in Filters Against Folly (1985) by Garrett Hardin ISBN 067080410X

“The problem in this world is to avoid concentration of power - we must have a dispersion of power.”

Milton Friedman - Big Business, Big Government http://www.youtube.com/watch?v=R_T0WF-uCWg

Fonte: Money Mischief (1992), Ch. 2 The Mystery of Money

Fonte: Money Mischief (1992), Ch. 2 The Mystery of Money

“One reason why money is a mystery to so many is the role of myth or fiction or convention.”

Fonte: Money Mischief (1992), Ch. 2 The Mystery of Money

Fonte: (1962), Ch. 13 Conclusion, 2002 edition, p. 198

Fonte: Free to Choose (1980), Ch. 1 "The Power of the Market", p. 14

Fonte: Money Mischief (1992), Ch. 2 The Mystery of Money

Introduction

Capitalism and Freedom (1962)

Contexto: The free man will ask neither what his country can do for him nor what he can do for his country. He will ask rather "What can I and my compatriots do through government" to help us discharge our individual responsibilities, to achieve our several goals and purposes, and above all, to protect our freedom? And he will accompany this question with another: How can we keep the government we create from becoming a Frankenstein that will destroy the very freedom we establish it to protect? Freedom is a rare and delicate plant. Our minds tell us, and history confirms, that the great threat to freedom is the concentration of power. Government is necessary to preserve our freedom, it is an instrument through which we can exercise our freedom; yet by concentrating power in political hands, it is also a threat to freedom. Even though the men who wield this power initially be of good will and even though they be not corrupted by the power they exercise, the power will both attract and form men of a different stamp.

Milton Friedman - Big Business, Big Government http://www.youtube.com/watch?v=R_T0WF-uCWg

"The Methodology of Positive Economics" (1953)

Fonte: Capitalism and Freedom (1962), Ch. 13 Conclusion

Interview with Richard Heffner on The Open Mind (7 December 1975)

Fonte: Capitalism and Freedom (1962), Ch. 6 The Role of Government in Education, p. 95

As quoted in The Money Masters (1995)

“You must distinguish sharply between being pro free enterprise and being pro business.”

Milton Friedman - Big Business, Big Government http://www.youtube.com/watch?v=R_T0WF-uCWg